Reporting Requirements for Charities (Winter 2015)

New reporting requirements for registered charities came into force from 1 April 2015.

This means that registered charities will need to prepare financial statements in line with these new standards. These will now require quite a bit more non-financial information than in the past.

While we’re geared up to continue to prepare your financial returns, we’d like to flag to you that from the 2016 financial year, we’ll need more information from you.

We don’t want to pass the costs of preparing this additional non-financial information on to you, particularly where the organisation is smaller and the costs will make a big dent. Also, as you’re the ones who best know what you do and why, you’re in a better position than we are to provide clear, accurate information.

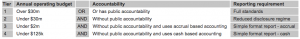

So, what additional information is called for? It varies according to the size of the organisation, its operating revenue and whether it has public accountability.

The requirements apply according to which tier the organisation falls into.

Very few charities are so-called FMC reporting entities or issuers or otherwise have public accountability, as defined. (An FMC reporting entity is defined under the Financial Markets Conduct Act 2013 and includes listed companies, banks, unit trusts, credit unions and other enterprises that hold lots of money from the public).

All charities will have to report on ‘service performance’. This is a report on what the organisation did to achieve its core objectives.

The reporting requirements distinguish between ‘outcomes’ and ‘outputs’. An outcome is the benefit you want to provide to the community, say ‘Improve the quality of life of those living with XYZ disease’. An output is the specific service (or goods) delivered, e.g. ‘Provide cheap/free accommodation near base hospitals for rural patients’ or ‘Train puppies to become guide dogs’.

Some charities only provide a few activities or services, which will make it easy for them to identify all the different parts to include in their reporting.

For others it might not be as straightforward, as they may have many activities or services which operate independently of each other. All these different parts of the charity must be reported on, as they all enjoy the benefits of being a registered charity.

What you have to do:

- Identify your organisation’s outcomes. They can often be derived from the mission statement.

- List your major outputs.

- Establish a system for measuring delivery of outputs. You will want to report quantities delivered, e.g. number of patients accommodated and/or number of nights, and optionally:

- Costs associated with the output

- Quality and

- Timeliness

- Prepare a budget for the delivery of outputs and

- Establish, if practical, the quantities delivered in the previous year

Leaving this until the end of the financial year will make it all MUCH harder. Start now!

If you have any questions or would like further information, please feel free to contact us.