FYI… Cash or Accrual Accounting

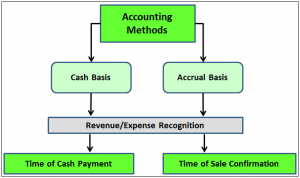

You’ll often hear the terms cash or accrual accounting.

You’ll often hear the terms cash or accrual accounting.

Is this when you tune out?

They’re the two main methods of keeping track of income and expenses.

They work in different ways so it’s good to understand how your financials are put together.

Cash

The cash accounting method records income in terms of the date the cash is actually received and not necessarily the date when the sale was made.

In the same way, expenses are recorded as at the date you actually made the payment, and not the date when you committed to the outlay.

With credit transactions, the key date is when it’s charged to the card.

Accrual

With the accrual method of accounting, income is counted from the date the sale is made (and that might be the date the customer put in their order or the date of delivery, depending on your terms).

In the same way, expenses are counted as at the date you committed to the outlay.

Sometimes it can be a little confusing to work out the date of transaction. The job completion date is all important here. If everything to do with the purchase has been received and installed, the job is complete and it can go on your books at that date.

Many smaller businesses use cash accounting as that suits them best. However, larger businesses use the accrual method.

It is also important to note that generally businesses are required to recognise income on an accruals basis for calculating income tax.

Therefore even if a cash accounting method is used for budgeting or cashflow purposes, adjustments for accrual accounting will be required to determine the correct amount of tax payable.

If you have any questions or would like further information, please feel free to contact us.