Don’t leave it late – get tax sorted before Christmas

Provisional tax and GST are due on 17 January.

Provisional tax and GST are due on 17 January.

The timing of these payments isn’t ideal as many of you will be indulging in the delights a summer break offers.

But it’s important that you don’t neglect your tax obligations – especially as Inland Revenue will charge 7.00 percent interest and late payment penalties if you don’t pay the tax you are required to pay on time.

That’s why we have put together some suggestions to help you get tax-ready before Christmas.

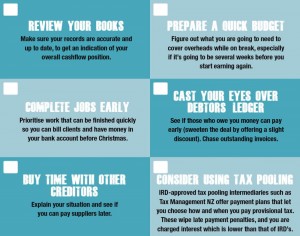

Review your books

Make sure your records are accurate and up to date, to get an indication of your overall cashflow position.

Prepare a quick budget

Figure out what you are going to need to cover overheads while on break, especially if it’s going to be several weeks before you start earning again.

Complete jobs early

Prioritise work that can be finished quickly so you can bill clients and have money in your bank account before Christmas.

Cast your eyes over your debtors’ ledger

See if those who owe you money can pay early (sweeten the deal by offering a slight discount). Chase outstanding invoices.

Buy time with other creditors

Explain your situation and see if you can pay suppliers later.

Consider using tax pooling

IRD-approved tax pooling intermediaries such as Tax Management NZ offer payment plans that let you choose how and when you pay provisional tax. These wipe late payment penalties, and you are charged interest which is lower than that of IRD’s.

As always, we are happy to work alongside you to come up with a strategy and talk through your options. Give us a call.